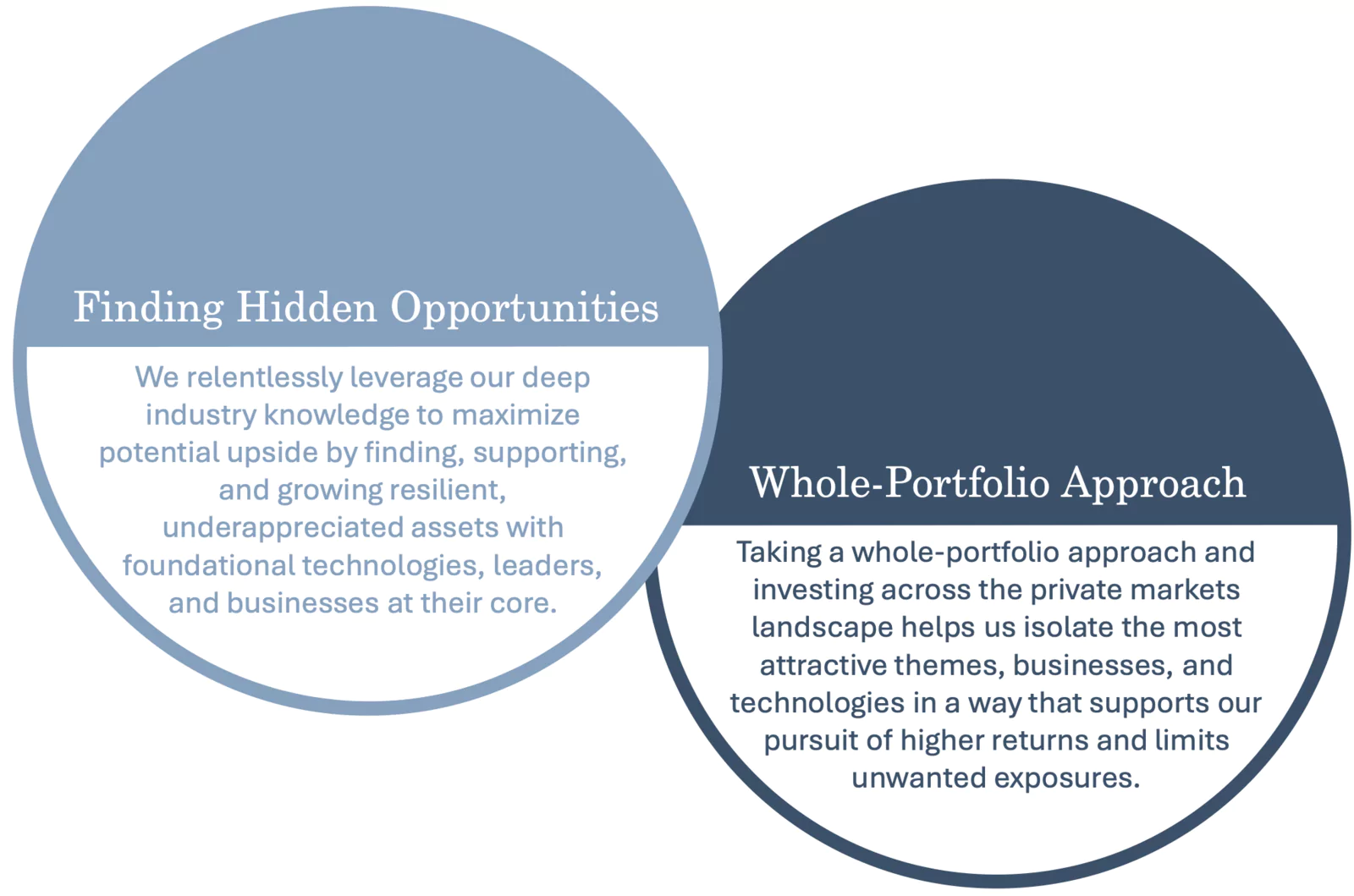

We use our industry expertise and whole-portfolio approach to identify, capitalize, and support both cutting edge and well-established companies to create sustainable value for our clients and community.

At Green Eight Capital, we are a mission-driven private markets investment firm.

Our goal is to deliver superior uncorrelated returns while shaping a better future by capitalizing generation-defining innovation, growth, and resilience in aerospace and adjacent industries.

We act as a partner to cutting-edge growth and mature companies in aerospace, government & defense, and space & future technology verticals. Our capital and expertise are deployed to help companies innovate in these industries, address supply gaps and industrial base considerations, and scale for growth.

Founded in

2018

by CEO Philipp Maurer

Our goal is to not only address a global need for foundational technologies, reconstituted supply chains, and resilient industrial bases but to also facilitate positive changes and competitive financial returns in the process.

Our leadership consists of a global team of investment, operations, and industry experts working to drive returns, shape outcomes at portfolio companies, and amplify positive externalities on behalf of our clients, partners, and communities. We are deeply rooted in both Europe and the United States, leveraging the power of global reach and perspective in our work.

Switzerland

8808 Pfäffikon, Switzerland

USA

New York, NY 10022

Luxemburg

5365 Munsbach, Luxemburg

Germany

60325 Frankfurt a. Main, Germany

We identify and direct capital into both mature and growing assets, seeking to deliver superior returns tied to a confluence of catalysts and actionable opportunity in aerospace and adjacent industries.

Aerospace

Aerospace production has fallen short of air travel demand as the industry faced pandemic-induced issues, providing an opportunity to capture a period of outsized growth. New solutions driven by tightening emissions standards has the potential to drive the future of aviation and offer significant upside.

Commercial Aviation

Commercial aerospace historically grows at a multiple of GDP with high barriers to entry. Aerospace is currently in a period of elevated growth rebounding from the Covid-19 bottom with structural demand tailwinds set to sustain current trends.

Aftermarket

Aftermarket / maintenance is driven by flight hours and aircraft age. New aircraft production rates have fallen short of demand, resulting in higher utilization and useful life extensions of the existing fleet, driving a favorable pricing backdrop.

Propulsion and Energy

Advancements in engine technology drive increases in fuel efficiency and ultimately aircraft development cycles. The same technological advancements can be applied to other applications such as wind turbines.

Sustainable Aviation

Sustainable aviation fuel, electric, hydrogen, and hybrid propulsion can bridge the current aviation industry to its climate emission targets but require significant investment to reach capacity.

42,595

New main-line aircraft

demand until 2042

12 years

Backlog for the most popular aircraft

at currently targeted production rate

$8.6tn

Required capital expenditure for

net-zero aviation by 2050

Government & Defense

With growing geopolitical tension and a rising threat environment, governments are scaling up expenditure to re-shore supply chains and improve operational readiness. Additionally, governments increasingly relying on the private sector to improve capabilities and capacity.

Defense Consumables

Stockpiles of materiel and other various consumables have long been neglected and drawn down in recent years as global tensions have escalated significantly. Governments face an urgent need to replenish and invest in building new reserves of consumables.

Data Analysis & AI

Governments are emphasizing a need to become more data-driven in their decision making globally. The ability to process vast amounts of data quickly is paramount to achieve this. Data Analysis & AI are at the forefront of government priorities to improve readiness.

Unmanned & Autonomous

The industry is facing a pilot shortage crisis which has been accelerated due to Covid-19 related retirements. The shortage is estimated to reach 30,000 pilots by 2032, driving the need for autonomous flight as a potential solution along with additional applications such as cargo.

Sealift

Sealift is one of the key pillars that makes up the government logistics network but much of the fleet is nearing retirement age. This dynamic underpins the need for recapitalization to undergo a replacement cycle in a timely manner.

55-65%

Forecasted defense spending

growth through 2026

$1.2tn

2022 military spend of NATO

countries

67%

Of NATO countries still working

towards the target military

spending of 2% of GDP

Space & Future Technology

Satellite miniaturization coupled with rapidly falling launch costs have catalyzed commercial growth of the space economy through structural cost decreases. Historically dominated by governments, the Space industry’s proliferation of commercial businesses presents a compelling opportunity.

Launch

Launch forms the gateway to space and will continue to be the rate limiting step for growth in the industry without investment. The speed at which the space economy grows is heavily dependent on the launch capabilities developed.

Satellite Manufacturing

Miniaturizing equipment allows smaller satellites to do more at a lower cost. Lower input costs lead to larger constellations and ultimately accelerates the expansion of applications and adoption of new technologies.

New Space Industries

Increasing access to space opens the door to new industries: asteroid mining high-value minerals, development and manufacture of medicine, biotech, and semiconductors in-orbit, along with an array of associated orbital services.

Future Innovation

We believe aerospace will be the foundation for a generation-defining technology inflection point. Examples include nuclear fusion, which can viably be a clean energy source, and quantum compute, capable of vastly improving processing power.

85%

Reduction in launch cost per kilogram

from 1970-2000 versus 2021

$366Bn

Market size of space economy

150%

Increase in number of satellites

in orbit from 2019 to 2022

Contact Us

Green Eight Capital AG

Zentrum Staldenbach 13

8808 Pfäffikon Switzerland

Green Eight Capital International Corp.

570 Lexington Avenue,

34th Floor New York, New York

10022, USA

IR@G8C.COM

+41417100808